Credit Card Integration to Certinia

This post on credit card integration to Certinia is part of a series highlighting our accelerators, which are common solutions and features for Certinia and Salesforce, that companies often request from CLD. We hope you find this useful..

Better Expense Management

This post is all about how you can automate and streamline your expense management processes in Certinia (formerly FinancialForce) by leveraging all the data that already exists in your corporate credit card transactions. With a simple integration, you can save your employees lots of time and trouble and increase accuracy.

Who knows, your employees might even smile when it’s time to submit expense reports?!

Don’t have time to read, view this feature at a glance.

Here’s why companies track expenses using Certinia

In the professional services industry, it’s typical for companies to track time and expenses incurred on projects. There are two main reasons to do this. First, by tracking expenses, billable expenses could be billed to your customer. Second, by capturing expense-related costs, you gain a complete picture of project financials even if they’re not billable.

Sometimes expenses are factored into your overall project cost so tracking actual expenses is just as important as tracking time spent on projects. And this is especially important if contractual agreements allow expenses to be billed to your customer.

Certinia PSA natively allows you to track expenses on expense reports and associate expense reports with projects. Additionally, Certinia PSA provides a variety of interfaces for capturing expenses and associating them with projects, including mobile, browser, and optionally, an integration with Concur. Some clients opt to integrate Concur with Certinia if the rest of the company uses Concur.

Other enterprises would rather integrate credit card transactions into Certinia to create expense items instead of having the user type in the information. So, if the latter sounds like something you need, we’ll explain how to evaluate whether a feature like this is right for you and share how we’ve implemented it for several companies.

Evaluating a credit card integration to Certinia

It’s best to consider a few things upfront when you evaluate integrating credit card transactions from your bank to Certinia. Based on our experience implementing Certinia and this integration for several companies, we recommend keeping these 5 things in mind.

5 Things to Consider

- Matching transactions to the correct employee. One thing to consider is how you will associate a transaction with a PSA Resource. For instance, if we have an “Employee Id” in the credit card file, we will want to make sure we can find the resource in Salesforce/PSA that corresponds to the Employee Id.

- Bank permissions around accessing credit card transactions. Know what your bank permits when it comes to accessing credit card transactions. For example, we’ve learned that some banks don’t allow customers to have an integration process that logs in and gets transaction data from them. Instead, the customer has to provide an environment where the bank can drop off a file over SFTP.

- Format of the credit card transactions and Certinia expenses. Knowing the format gives you an idea of the level of effort needed. It will be necessary to parse the transactions and get them ready for use in Certinia. To do this, you’ll likely need help from your Salesforce Admin (Apex coding) and PS Ops group (mapping the transaction fields to the expense item fields.)

- Level of automation needed. Some or all these pieces could be automated depending on what makes sense for your business. (Note: there’s always the option of not automating the handoff and instead of downloading & importing the transactions manually rather than on a scheduled basis.)

- Receiving the file with corporate card transactions

- Parsing the file to read the transaction data

- Importing the transactions into to Salesforce

- Encrypting and storing the transaction file (or deleting it once processed)

- How users will assign transactions to expense reports. Users will need an interface that allows them to easily see their corporate card transactions (and nobody else’s), create new PSA expenses from them, map them to already-created expenses, and provide additional details (description, expense type, receipt attachments, etc.), itemize them, and handle personal or invalid transactions.

Whew! That could seem like a lot to consider, but don’t worry, the upfront work pays off. Keep reading to see how we make our integration work as it might give you some ideas.

About our Credit Card Integration for Certinia

As mentioned above, we’ve implemented our credit card integration for several companies that use Certinia and provide corporate credit cards to their employees for company expenses. (And, we use it too — and it’s a time-saver!)

Features in a Nutshell

- Who might need this: Any company that issues corporate credit cards, uses Salesforce or Certinia, and needs to have expenses tracked as part of total project costs.

- What banks are supported: Bank of America, Wells Fargo, and more can be supported with minor modifications.

- How does it work:

- Brings credit card transactions into Salesforce from a bank file

- Gives users a simple interface to quickly tag, manage and assign expenses to the right expense report

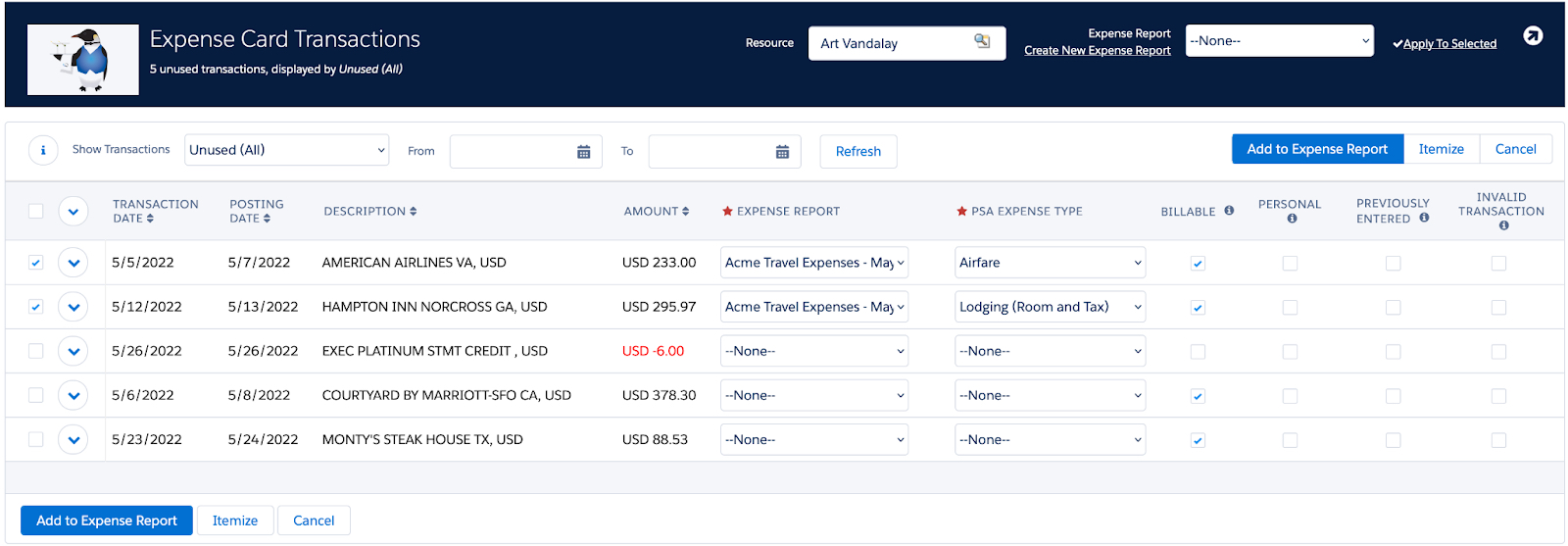

One view to assign Credit Card Transactions to an expense type, itemize, and more (click image to enlarge)

Saves Time and Increases Accuracy

This feature saves companies time because the solution creates expenses. It increases accuracy because transaction names, amounts, and dates are brought in from corporate statements directly. Accounting processes are significantly easier because financial managers can reconcile monthly statements faster after users assign expenses to expense reports.

How does the integration work

First, employees use their corporate credit cards as usual. Next, credit transactions are routinely brought into Salesforce via an integration with the bank that issues your corporate credit card. Employees are notified via email that new transactions are available.

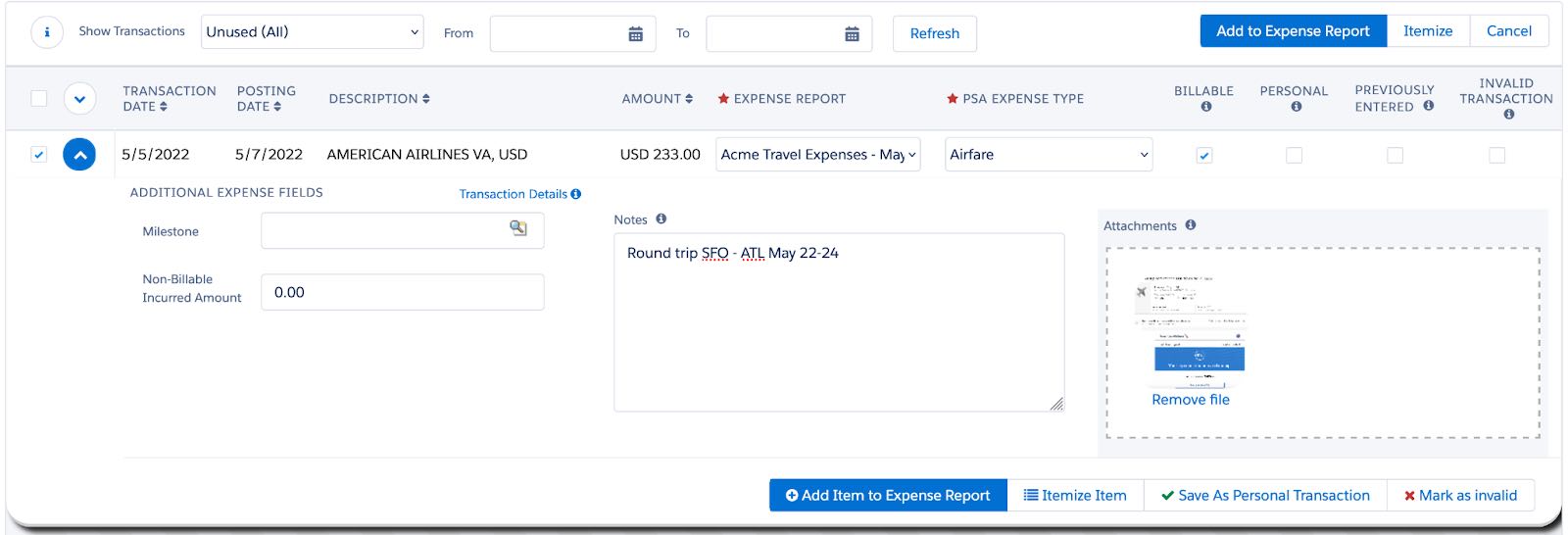

Then employees can match the expenses to one or more expense reports. After that, our solution features a custom screen that allows each employee to see only their unmatched expenses. On that screen, folks can create expense reports with one click. It’s easy to attach receipts and itemize expenses in one easy view.

Attach Receipts via Drag and Drop (click image to enlarge)

Itemize Transactions Quickly and Correctly (click image to enlarge)

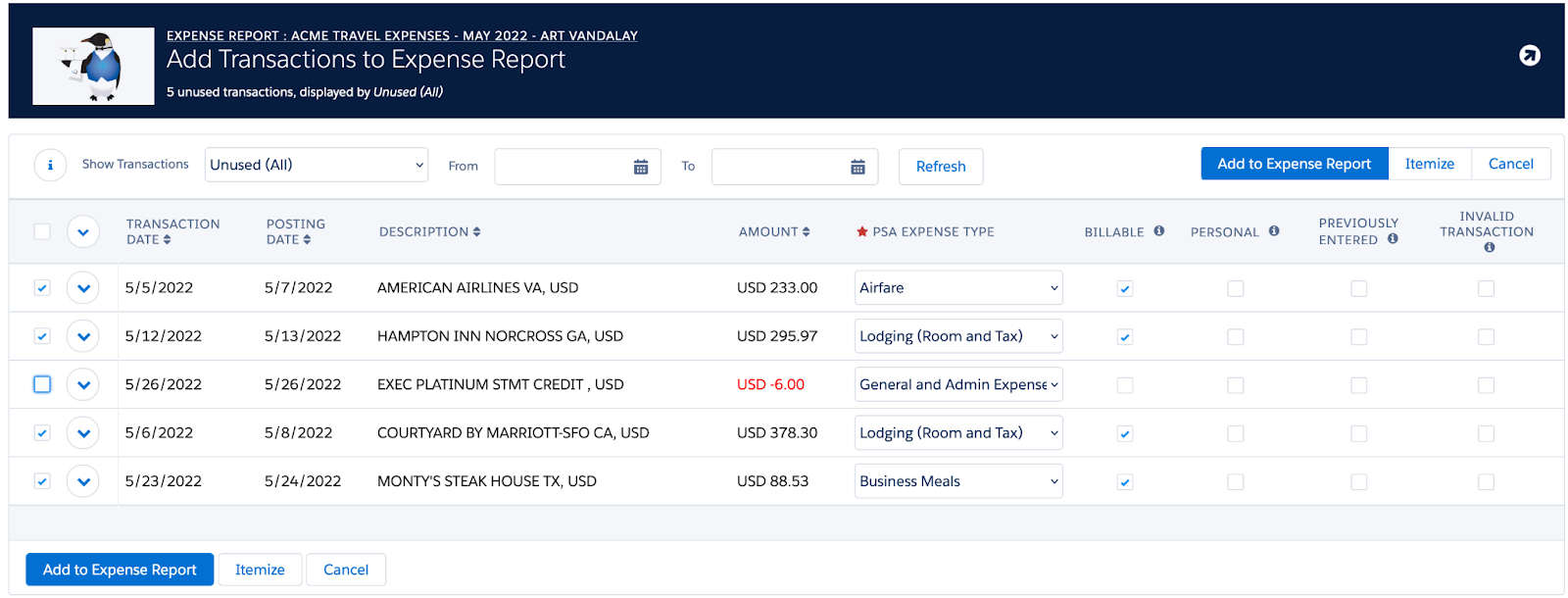

Next users specify the expense type and assign transactions to expense reports. When the user is ready, they can add the transactions to one or more expense reports in one click. That’s when the integration automatically creates Certinia Expense Items on the expense report.

After selecting one or more transactions, can add transactions to Expense Reports (click image to enlarge)

Want to see more? Just request a demo of this credit card integration solution.

What’s involved in the implementation?

We think it’s pretty straightforward (but we’ve been using it for a while so you can rely on our clients’ testimonials.) Like most of our implementations, we start by reviewing your Certinia implementation to understand how you use Certinia. Then, we talk about what you want to achieve. After that, the standard approach for this feature looks a little like this:

- Install the Feature: We deploy the package to your sandbox

- Establish Credit Transaction Feed: Next we provide the company guidance on how to work with your credit card provider to receive a feed of the credit card transactions on a scheduled basis

- Configure: We configure the feature based on your unique Certinia needs

- Test, Train & Explain: Like any app, it needs to be tested in your environment with your users. We’ll provide an end-to-end demonstration of the configured solution along with a training guide so you can handle any questions that come up.

- Deploy & Enjoy: Deploy the solution to your production environment and enjoy assigning expenses rather than lots of tedious typing (names, amounts, dates, etc.)

Technical Requirements

This may go without saying that you need Salesforce and Certinia PSA to use this credit card integration to Certinia feature. And, here are a few other things to know:

- Works in Salesforce Classic and with Lightning Experience (LEX)

- Supports Multi-currency

- Package Contents:

- Custom Objects: 5

- Custom Pages: 2

- Other Apex Components: 14 Classes & Triggers

- Custom Tabs: 3

- Other requirements:

- The issuing bank for your company’s Credit Card will be able to provide the transaction feed – and if necessary, we’ll modify the format of the feed from the customer’s bank if it’s in a format we have not dealt with previously.

Summary

Integrating credit card transactions from your bank into Certinia PSA requires a little planning and time to set up however, it will save you a lot of time in the long run and likely make your employees happier.

We use this feature at CLD and it’s great. And so, I love how easy it is to create an expense report and in a few easy steps assign 20+ expenses to multiple expense reports in one click. If you’re interested in a demo of our feature, just drop us a note.

If you use Concur, no worries, we’ve integrated Concur with Certinia for numerous clients, contact us if you need help.

The CLD credit card integration to Certinia is just one of the more than 50+ pre-built feature components we offer. So, it’s perfect for companies who want to automate and streamline their expense management processes in Certinia by leveraging all the data that already exists in their corporate credit transactions.